irs unemployment income tax refund status

For the latest information on IRS refund processing see the IRS Operations Status page. Paul MN 55164-0054 Income Tax Return Payment M60 0012 Income Tax Return Payment.

Tax Refund Timeline Here S When To Expect Yours

You cannot check it.

. The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed. Use the Wheres My Refund tool or the IRS2Go mobile app to check your refund online. The IRS has just started to send out those extra refunds and will continue to send them during the next several months.

This is the fastest and easiest way to track your refund. The unemployment tax refund is only for those filing individually. The systems are updated once.

IRS to send refunds for taxes paid on unemployment benefits. Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1 Form. Make check payable to Minnesota Revenue and mail to.

For you and your family. Check your unemployment refund status using the Wheres My Refund tool like tracking your regular tax refund. If you received unemployment benefits in 2020 a tax refund may be on its way to you.

The Internal Revenue Service doesnt have a separate. The exact refund amount will depend on the persons overall income jobless benefit income and tax bracket. To report unemployment compensation on your 2021 tax return.

June 1 2021 435 AM. Individuals abroad and more. Its taking more than 21 days for IRS to issue refunds for certain mailed and e-filed.

Its best to locate your tax transcript or try to track your refund using the Wheres My Refund tool. Irs Sends 430000 Additional Tax Refunds Over Unemployment Benefits.

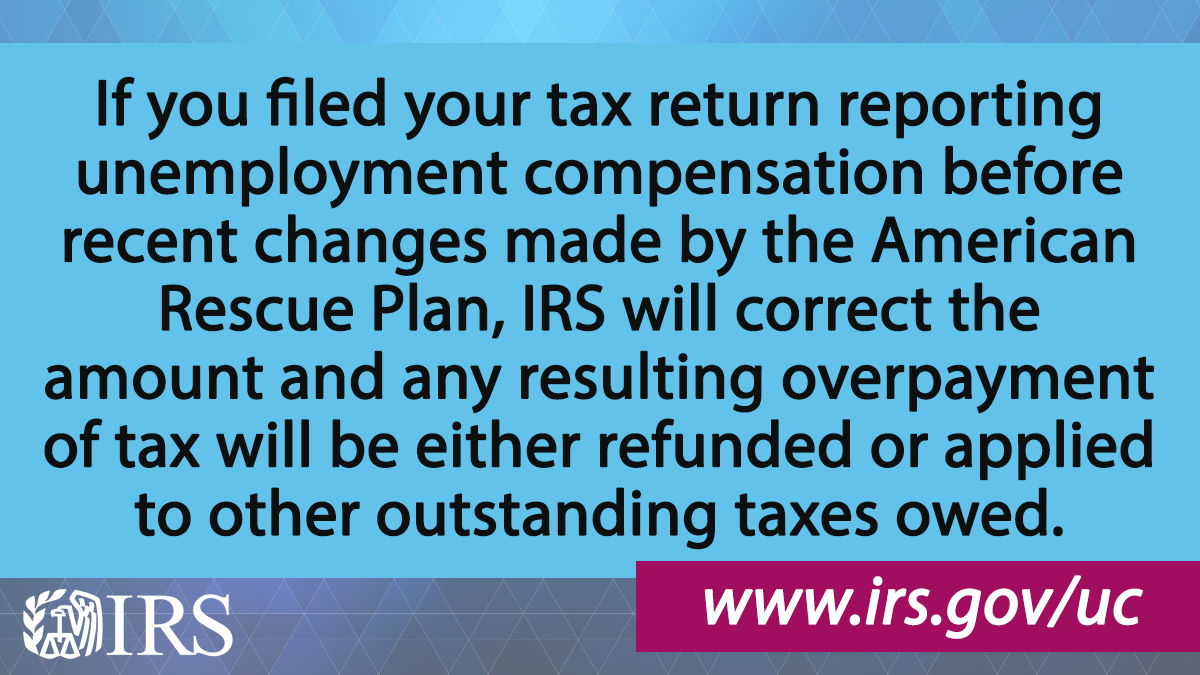

Irsnews On Twitter Irs Will Refund Money This Spring And Summer To People Who Filed Their Tax Return Reporting Unemployment Compensation Before The Recent Changes Made By The American Rescue Plan See

Tax Refund Delay What To Do And Who To Contact Smartasset

Irs Unemployment Tax Refunds May Be Seized For Unpaid Debt And Taxes

Irs Refund 4 Million Tax Refunds For Unemployment Compensation Marca

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

Important Irs Announcements Taxpayer Advocate Report Highlights Delays In Processing Returns Ceiba

Filing Your Taxes If You Claimed Unemployment Benefits What To Know Where To Find Help Kqed

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Did You Receive Unemployment Benefits In 2020 The Irs Might Surprise You With A Refund In November

Irs Starting Refunds To Those Who Paid Taxes On Unemployment Benefits

Where S My Refund Where S My Refund Status Bars Disappeared We Have Gotten Many Comments And Messages Regarding The Irs Where S My Refund Tool Having Your Orange Status Bar Disappearing This Has

1099 G Unemployment Compensation 1099g

When Will I Get My Irs Tax Refund Latest Payment Updates And Tax Season Statistics Aving To Invest

If You Got Unemployment Benefits In 2020 Here S How Much Could Be Tax Exempt Abc News

Here S When You May See A Tax Refund On Unemployment Benefits Up To 10 200 Pennlive Com

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

2 8 Million People Are Getting Irs Refunds This Week 10 Million More May Get Money Too Wbff